Deep Dive #2: Comet (COTN) - The Insider’s Cycle Trade

What if the best timing signal in this semiconductor supplier’s stock came from its management?

After my deep dive on TFG (up ~12% since I published it last month), I’ve decided to come home in every sense of the word.

If you’ve read any of my older (and admittedly, pretty amateur) posts, you’ll know I’m Swiss and obsessed with insider transactions. With Comet AG (Ticker: COTN), I’m bringing both of those back. Here’s the full breakdown.

1. Introduction

Comet AG (COTN) was founded in 1948 and listed on the SIX Swiss Exchange in 2002, after initially debuting on the Berne exchange in 1996. It is currently a component of the SPI Extra (ticker: SPIEX) with a market cap of ~CHF 1.5 bn (as of August 2025). It is a Swiss tech company that builds high-precision tools using X-rays and radio waves, with its core business in plasma control technology.

To keep it simple, if AI is the gold rush, Comet’s main business is to sell the parts inside the machines that make the picks and shovels: its RF plasma-control parts sit inside the tools that make the chips powering AI GPUs.

In my opinion, Comet is a great company (and I’ll get into that later), but that’s not really why it deserves a full Deep Dive here. What makes it stand out to me is something else: its insiders seem to have a real talent for timing their trades, and a recent earnings “miss” just handed them a golden setup.

What follows is my own view on why going long Comet makes sense, and where I see the upside from here.

To do that, I’ll break this down in two parts:

Comet AG

I’ll walk you through what the company does, how it’s been performing, and where it stands in the current market backdrop.

The Setup

Why I think now is the right moment to be long Comet, and how management’s own trades fit into the picture.

2. Comet AG

2.1 Overview

Comet’s business started with X-ray tubes for medical use, but it’s come a long way since then. I could walk you through the whole story, but honestly this video probably does a much better (and more entertaining) job than I would.

What matters most is what they’re doing now: developing and manufacturing high-tech components and systems based on their core strengths in X-ray technology and RF (radio frequency) plasma control.

Sounds complicated, I know, but it basically means they make the X-ray gear used to inspect products and the RF power systems that control the plasma inside chip-making machines.

This process is organized into three primary business segments, I’ll break it down with the 3 W’s:

Plasma Control Technologies (PCT)

This is the star segment. AI/Semiconductor related and Comet’s main revenue driver.

What they make: High-tech parts that control plasma (an ultra-hot gas) used in chipmaking machines.

Why it matters: These parts help companies like TSMC or Intel build smaller, faster, more powerful chips with better precision.

Where it's used: In the machines that make semiconductors, the heart of everything from phones to data centers.X-Ray Components (IXM)

The first of their 2 X-ray segments. While most people think of X-rays in a medical context, Comet actually exited the healthcare space around 2002. Today, it’s 100% focused on industrial and security uses.

What they make: The “engines” behind industrial X-ray machines, basically the tubes and power units that generate X-rays.

Why it matters: Their tech helps factories inspect parts (like car engines, airplane wings, and electronics) for hidden defects without taking anything apart.

Where it's used: In factories, airports, security systems, or anywhere high-quality X-ray vision is needed.X-Ray Systems (IXS)

The segment related to their Yxlon brand, which Comet bought in 2007.

What they make: Full X-ray and CT scanning machines, mostly sold under their Yxlon brand.

Why it matters: These are plug-and-play inspection systems for quality control (think of them like MRI machines for industrial use).

Where it's used: By automakers, aerospace companies, electronics manufacturers, and research labs to scan batteries, circuit boards, turbine blades, and more.

2.2 The Numbers

Now that you know what Comet does, let’s look at how it’s been performing. Don’t worry, I’ll keep it big picture, this isn’t about drowning you in numbers.

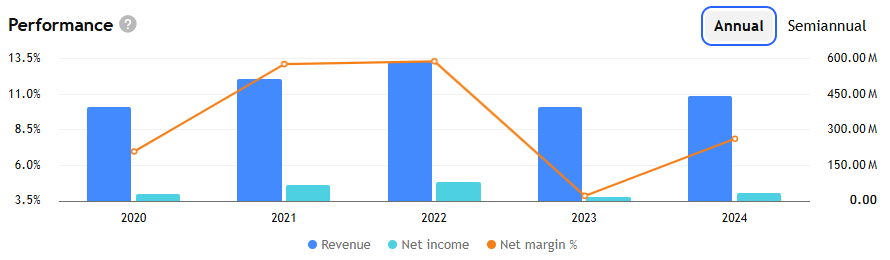

From the topline alone, the business looks healthy:

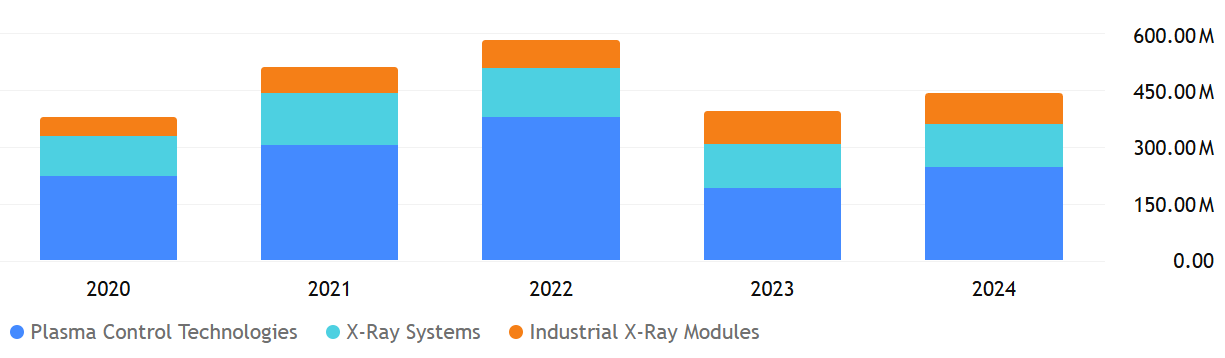

The company makes money every year, moving with the ups and downs of the semiconductor cycle. This makes sense, since the main segment depends directly on chipmakers’ capex. IXM and IXS help smooth things out, but when you split revenue by segment, it’s clear who’s really pulling the weight:

To see where Comet stands in its space, and how the market values it, I think there are two peers worth putting it side by side with:

Advanced Energy (AEIS, US)

Sells precision power supplies and related gear used in chipmaking and select industrial markets.

Why it’s a good comp: Closest operational analogue to Comet’s core PCT business.VAT Group (Switzerland)

Maker of vacuum valves used in semiconductor equipment.

Why it’s a good comp: Swiss “picks & shovels” like Comet but larger and more service-heavy.

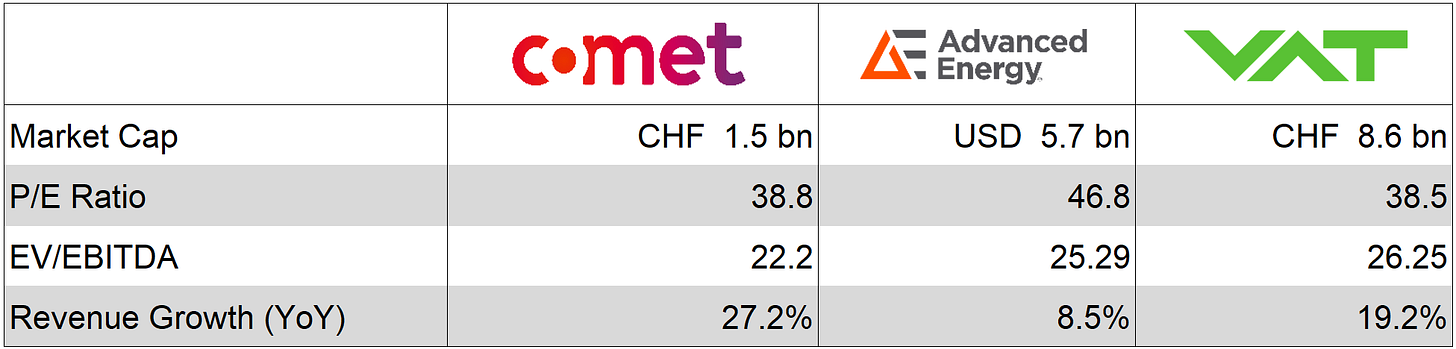

Here’s the situation summarized with a couple key metrics:

Comet’s the smallest name in the group but it’s growing the quickest. Despite that, P/E sits roughly in VAT territory and cheaper than AEIS, and it still trades below both peers on EV/EBITDA.

We’re clearly not paying a premium at these valuations, and if the growth story stays intact, the future could get very interesting.

The point is simple: Comet’s in good shape and stacks up well against its peers. But the real opportunity isn’t in the past but in the setup. And to see that, we need to look at what happened on July 31, 2025.

2.3 The Latest News

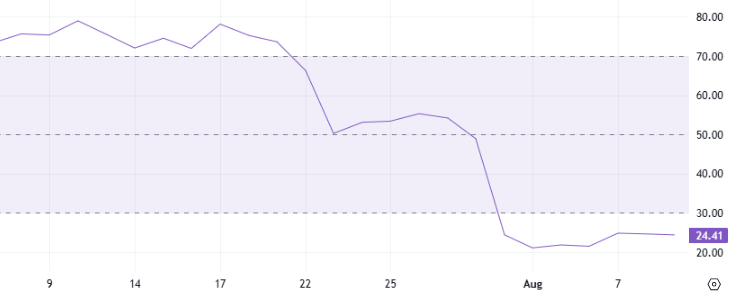

As I said, a big part of my thesis comes down to timing. Comet dropped its first-half results on July 31st 2025, and the market’s reaction was brutal, just look at what happened to the stock after the H1 ‘25 print:

You guessed it: the drop on the chart came on results day (-22%). So what exactly happened to make the stock tank like that?

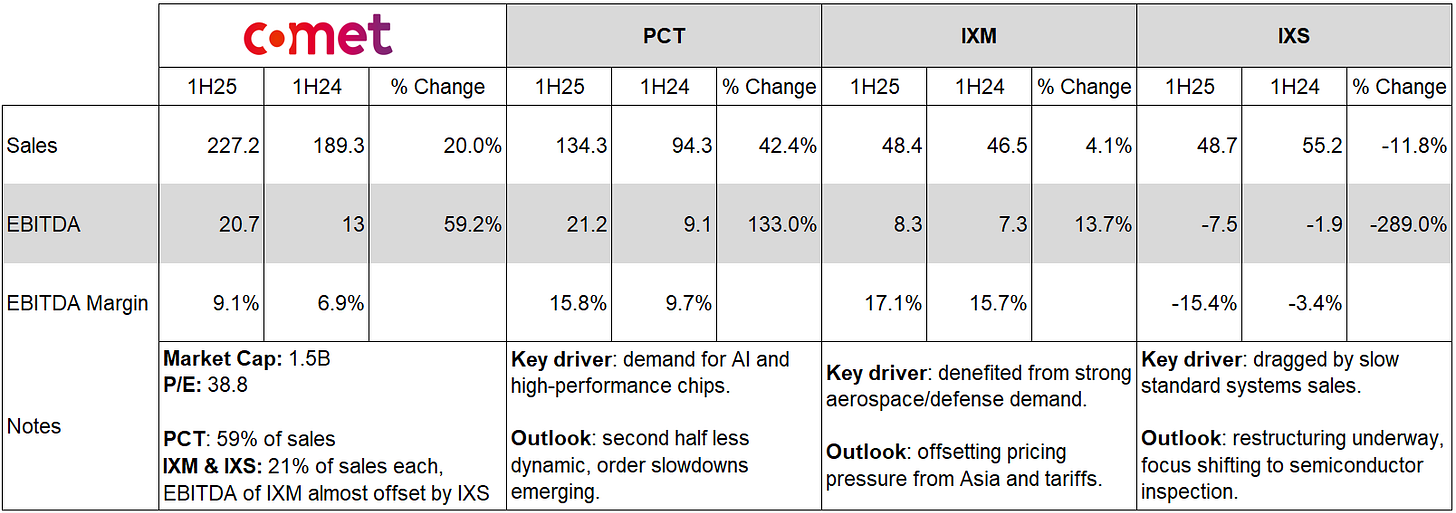

Let’s take a look, here’s the table:

Let’s go through it block by block:

Plasma Control Technologies

PCT is clearly the star of the show. Its growth is powered by the industry’s heavy investment in AI and high-performance computing.

It’s simple: AI companies like OpenAI need massive computing power → that means GPUs from Nvidia and friends → which need advanced chips made on ASML’s and other top-tier tools → and those tools can’t run without the plasma control tech Comet builds.

Once Comet wins a customer, it tends to keep them. Its small but critical power-control parts are built into chip-making tools, and swapping them out is risky, slow, and costly. With proven, finely tuned gear, Comet stays in place for years, turning each customer into repeat orders (plus spares) and supporting healthy pricing power.

And I don’t see that growth slowing anytime soon, as Comet is currently rolling out its Synertia® RF Power Delivery Platform, a system that combines its key RF components and software into one package. This shift from selling parts to selling a full platform makes each sale larger, keeps Comet locked into customers’ machines, and drives repeat orders.X-Ray Components

Textbook stable growth here. It’s not the centerpiece of my bull case, but it’s valuable that Comet isn’t only tied to semiconductors. IXM gives exposure to other long-term industries like aerospace, which can offset some of the ups and downs in chip demand. Semiconductors run in cycles, so it helps to have a part of the business that can keep things steady when chips slow down.

X-Ray Systems

I know you raised an eyebrow when you saw that EBITDA % change. Yes, Comet got hammered in this segment, but I don’t think it’s as bad as it looks. This slump is largely the result of the current restructuring program, where Comet is deliberately shifting focus and resources toward semiconductor inspection. Management doubled down on this plan in last month’s earnings report, with CEO Stephan Haferl saying the underperforming X-ray division IXS will be reoriented in the second half of the year to adapt to current market conditions:

“It's relatively straightforward in IXS. The efficiency measures, the restructuring measures we are planning are going to be executed to the very largest part in 2025.” - Comet H1 ‘25 Earnings CallTo me, that’s a sign of a team willing to act early rather than wait for the market to force their hand.

With all this in mind, it’s clear the stock didn’t tank because the top line was a disaster. We can see that Comet works because the pieces fit together. PCT, powered by the AI-driven surge in semiconductor demand, does the heavy lifting and drives profits. IXM is the steady, non-semi piece that smooths the ride, and while IXS is a drag right now, management has a clear plan to get it back on track.

However, management cut FY25 guidance to CHF 460–500m in sales and a 10–14% EBITDA margin (from CHF 480–520m and 17–20%). They also indicated that PCT volumes are likely to remain flat through the second half of 2025, with some orders potentially shifting into the first half of 2026. In other words, the rebound may arrive later than investors initially expected. I’ll spare you the tariff angle (like almost every other earnings report this season, it was mentioned) as I don’t think that’s what pushed the stock off a cliff.

In short: the earnings were fine, but management’s outlook scared the market.

So where does that leave us? I believe I’ve established the following:

With Comet today you’re buying an AI “picks & shovels” supplier with a built-in shock absorber (IXM) and a turnaround option (IXS).

Comet’s a good business that holds its own vs peers: fastest grower in the group, clean execution, and still not priced like a darling.

The selloff was guidance-driven, not structural. H1 itself was fine but the FY cut and pushed-out PCT rebound spooked the market.

Which brings me to the heart of my case: Comet looks oversold post-earnings, and the same management guiding caution is the one lining things up for the rebound.

3. The Setup

3.1 Oversold Earnings

My thesis is all about timing, the stock being down ~26% since the July 30, 2025 close (a big move for a guidance reset). I could just point to the RSI and call it oversold (which it is), but that’s not the real argument. Still, I’ll show it anyway, because why not:

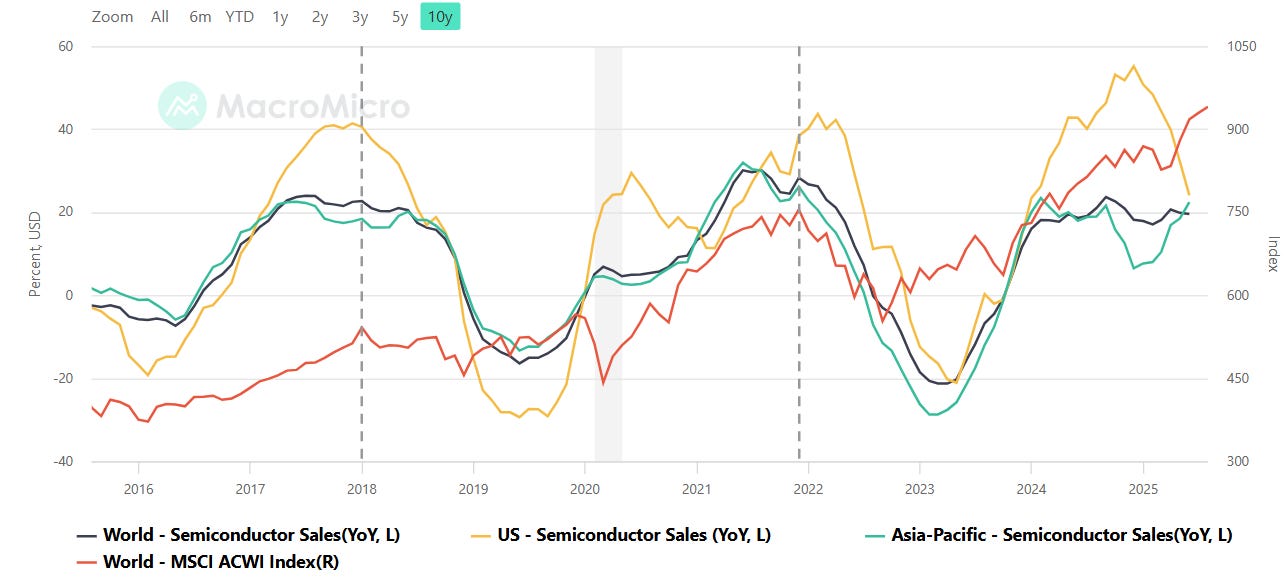

But there’s something more telling: remember how I said Comet follows the semiconductor cycle? Put its price chart next to the cycle and it’s hard to miss.

The pattern’s pretty clear, Comet’s stock leads the semiconductor cycle, but with a twist: buying tends to start well before the cycle turns up, and selling doesn’t finish until right at the cycle’s peak. By then, investors have already priced in the slowdown they know is coming. The July guidance cut was just the final push lower.

That’s exactly when I want to buy, because history shows the cycle’s peak often lines up with the start of the stock’s next move higher, and I’m pretty sure I’m not the only one thinking like this.

3.2 The Insiders

This is what put Comet on my radar in the first place. I’ve been tracking insiders in the Swiss market for five years (even wrote my thesis on it), so I’m very confident when I’m telling you this:

Comet’s insiders are some of the best in the business at timing their buys.

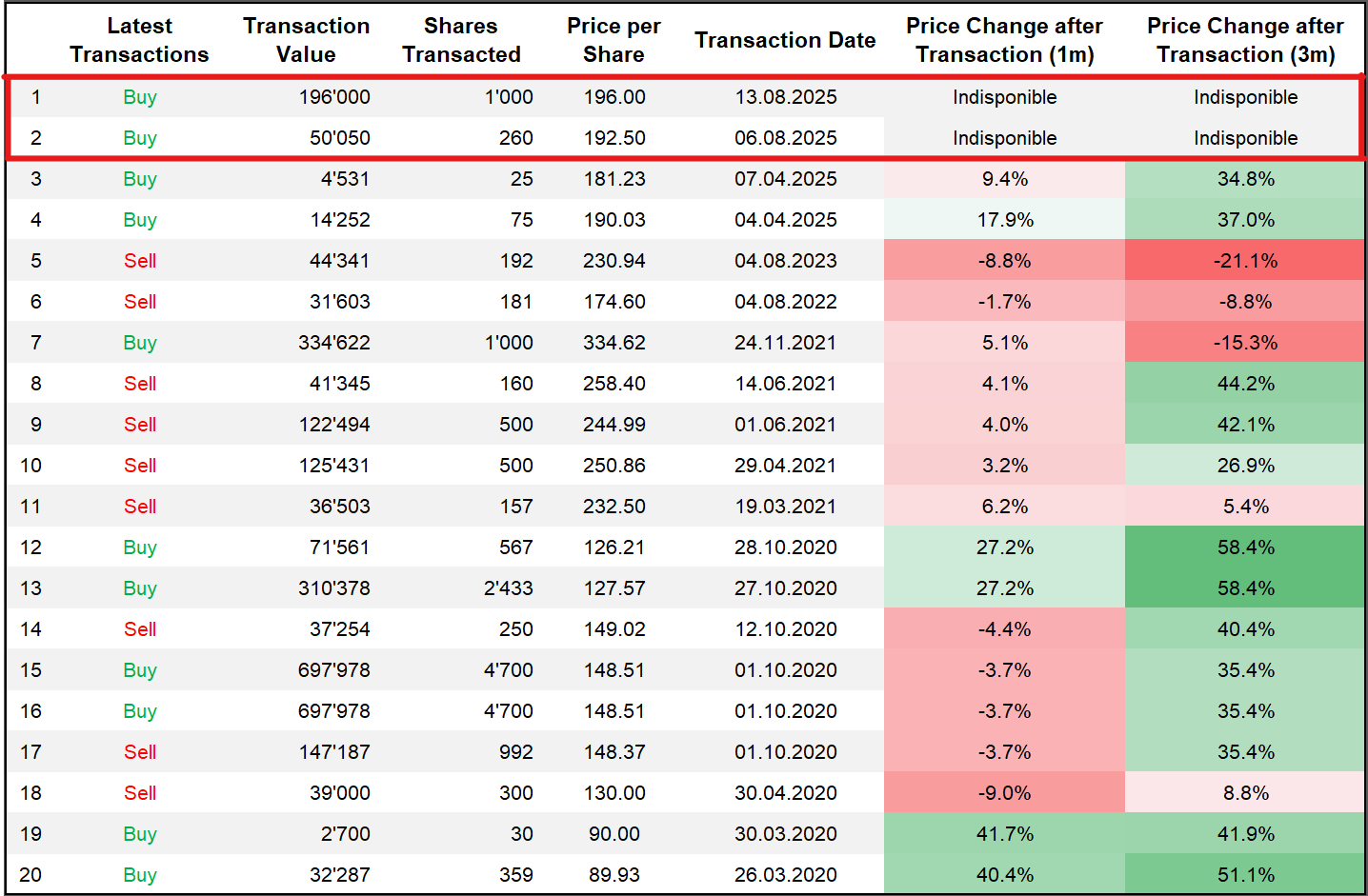

Here’s a chart of the insider transactions for Comet over the past 6 years:

Transactions which you can also find listed here:

As you can see, insider activity was heavy in 2020–2021, and those buys were nailed almost perfectly. Then… nothing. For years, not a single group transaction. That’s why I really started paying attention when they stepped in this April, buying the dip after Trump’s tariff announcement… and sure enough, the timing was spot on, with the stock rallying hard into earnings.

And now? Well, you can probably guess where I’m going with this, look who’s been buying again right after the post-earnings selloff.

I’ve made the case that Comet’s a solid company in a hot market, but no one knows it better than management. And when their past group buys (multiple buys in a 1 week span) have averaged a 44% return just three months later, you pay attention.

3.3 Outcomes

So, what are the possible outcomes here? For me here’s what could tip the balance:

What could go right:

Insiders know something: In ALL of their past group purchases, insider buying has marked a local bottom in Comet’s share price. If history repeats, we could be looking at the same pattern here, with the potential for the ~44% average return we’ve seen before. That would put the stock around CHF 280.

The semiconductor cycle plays its part: Over the last two cycles, Comet’s share price has tracked the semiconductor industry closely. With nothing fundamentally wrong at the company, a repeat of this pattern could see the stock push to new all-time highs. That would mean a target of CHF 365 (+88%).

AI keeps the party going: The AI boom shows no signs of slowing down. If it makes the current semiconductor downcycle less severe than usual, order flow could rebound faster than expected, rendering Comet’s recent guidance too conservative.

Execution beats the macro: Even if the broader environment remains challenging, Comet could still create value by delivering on its IXS turnaround and successfully rolling out its Synertia® product line. Catching up to the bigger players (Advanced Energy) in market cap terms could take the stock to CHF 400+ (+100%), with the exact upside depending on macro conditions.

What could go wrong

Insider signal fails: Even if history is on our side, insider buys are never a sure thing. This year’s purchases could be random, or management might have underestimated the macro headwinds hitting Comet. If that’s the case (or if any of the following risks play out) remember that the five-year low sits at CHF 144, about -25% below today’s price.

AI spend cools or shifts: If we really are in an AI bubble and it pops, budgets could pause or shift toward areas where Comet has less exposure. Orders would arrive later than hoped, guidance could be cut again, and instead of a recovery the stock could drop sharply.

Cycle lasts longer: The semiconductor downturn could drag on longer than usual. Customers keep cutting capex, orders slow, backlog shrinks, and margins reset lower, especially if an AI slowdown adds fuel to the fire.

Execution or competition issues: The IXS turnaround takes longer than expected or Synertia® fails to gain the expected traction. Big customers delay orders, and competitors win deals on price or features.

Broader market risks: Geopolitical and macro shocks (like renewed U.S. tariff pressure under Trump) could weigh on sentiment and demand.

4. Final Thoughts

As I said, with Comet you’re getting an AI “picks & shovels” supplier (PCT), a steadier X-ray business (IXM), and a turnaround in progress (IXS).

The big drop after July results came from guidance, not from a broken business. Management sounded cautious, then bought shares. That combo gets my attention.

The upside is simple. AI gear still needs to be built, and once Comet’s parts are inside a tool, they usually stay there. Synertia® should help make each sale larger and stickier over time. The market sold first and asked questions later, so the insiders with a high win rate stepped in. Add to that the fact this stock has historically turned before the semi cycle, and the charts suggest we could be right at that turning point.

Good company, bad headline, clean entry → That’s my setup.

Could I be wrong? Sure. Insider buys don’t always work. AI budgets could pause or shift. The semiconductor slowdown could run longer. IXS could take more time, or Synertia® could ramp slower. Tariffs/FX can also bite. But the case looks compelling to me, and the insider angle really pushes me over the edge. It served me well with Montana Aerospace (see last year’s writeup, up +48% since), and I think it will again.

So what am I watching next? That’s simple, I’ll be tracking any new insider transactions and keeping an eye on the semiconductor cycle to see if it lines up with Comet’s chart.

On the company side, the key things will be IXS restructuring milestones, early Synertia® wins, and what major customers say about spending. If those start to come together, I think the stock follows, regardless of the macro backdrop.

I’d love to hear your thoughts or questions, feel free to reach out if you’d like to discuss this further!

Disclaimer: I’m not a financial advisor and this write-up is for informational purposes only, not investment advice. I currently hold Comet shares as of August 2025 and may buy or sell at any time. Past performance is no guarantee of future results. DYODD.

Excellent Analysis... Sold Puts!!

Solid points. Really enjoyed this!